Shanghai Recap + New Dashboard Features

gm,

It’s been less than a week since the Shanghai (aka Shapella) upgrade took effect — a major update that completed Ethereum’s transition from Proof of Work to Proof of Stake.

We issued a press release on why we believe this upgrade will continue to drive adoption, create new access points for the TradFi community, and result in more participation when it comes to Ethereum staking.

But before we examine highlights from that big event, we want to share some news about our staking dashboard…

We Launched New Features 🚀

There are two big updates we rolled out this week that we’re excited to tell you about!

1. Grouping & labelling validators: We’ve created different labels and grouping options so users can pinpoint their activity and track progress across multiple service providers, custodians, clients and MEV relays. The dashboard can also group validators by jurisdiction to make it easier for businesses or individuals in different regions that have varying accounting requirements.

2. Network APR: Stakers can now use our dashboard to benchmark their annual percentage rate (APR) against the network average. This will help them decide how and where is best to stake ETH in order to maximize their rewards and staking operations.

Network diversity matters to us, which is why we want to give users access to as much information as possible so they can make informed decisions when it comes to staking. These latest features are just the tip of the iceberg and we plan to introduce new metrics on technical performance and MEV in the coming weeks.

In addition to these recent updates, our engineering team has been working hard on technical improvements to enhance the overall user experience. We want to be able to support a large number of validators, accounts and most importantly build a product that stakers can rely on.

But we need your help!

This is just the beginning of our dashboard journey and your feedback plays a key role in shaping our product roadmap.

If you haven’t tried out our dashboard yet, make sure you sign up to access our free beta program. You can also hangout in our Discord server and ask questions or share your user experience.

Shanghai Unlocks ETH Liquidity 💸

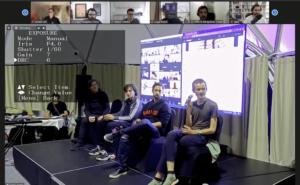

Ether Capital CEO Brian Mosoff joins CNBC’s Crypto World to talk about the Shanghai upgrade

Ever since the Beacon Chain launched in late 2020, Ethereum was a one-way bridge for staking deposits. Those who have staked have been sitting on a nest egg of consensus layer rewards and unable to access any ETH they locked in the protocol. Fortunately that is no longer the case. On April 12, Shanghai was successfully activated and both full and partial staked ETH withdrawals have been enabled. The upgrade is considered a huge technical achievement and historic milestone by many in the Ethereum community — including us at Ether Capital!

We spoke with Bitcoinist, Blockworks, and a few other media outlets about why we believe Shanghai will spark a new wave of enthusiasm for Ethereum and ETH staking.

Some highlights from the past week:

- The price of ether reached an 11-month high punching above US$2,100.

- More than 1 million ETH has been withdrawn from the blockchain since Shanghai was activated, most of which has been partial withdrawals (i.e. consensus layer rewards).

- As expected, it’s taking longer for full withdrawals to occur. The wait time is upwards of 17 days as roughly 28,000 validators are looking to exit (about 5% of network validators). We explained how full and partial withdrawals work in a recent article we published.

Shanghai Watch Party 👀

About 4,000 people tuned into the viewing party hosted by ETHStaker and Ethereum Cat Herders, both are organizations that support the development of Ethereum and the wider community. Ethereum’s co-founder Vitalik Buterin took part in the event and touched on what’s next for the leading smart contract platform.

“We’re in a stage where the hardest and fastest parts of the Ethereum protocol’s transition are basically over. Very significant things still need to be done, but those very significant things can be safely done at a slower pace.”

Next stop? Scaling Ethereum. Developers are focusing on making transactions cheaper and faster. We’ll keep you posted on their progress and capture the latest news in upcoming newsletters so stay tuned!

Upcoming Events 📅

If you have tickets to CAASA’s Family Office Summit next week, make sure you stop by one of our table talks:

WHEN: Wednesday, April 26 at 1:30pm ET

WHERE: Arcadian Court, 401 Bay Street, 8th floor, Toronto, ON

Ether Capital President & CFO Ian McPherson will discuss the use case for cryptocurrencies like ether against the backdrop of faltering U.S. banks (i.e., Silvergate Bank, SVB). He will also share an overview of our company and explain why now is the time traditional investors should pay attention Ethereum, especially following the Shanghai upgrade.

P.S. We also have cool swag to handout at the event. There are limited quantities so make sure you stop by before it’s gone 👀 ☕

Newsworthy Links & Highlights 🗞️

- Christine Kim, VP of research at Galaxy Digital, addresses misconceptions about what to make of withdrawal activity post-Shanghai. (Twitter thread)

- a16z released its 2023 State of Crypto that reveals a steady stream of development, product launches, and ongoing innovation taking place across the industry. (Report)

- Unchained Capital, a Bitcoin lender and custodian, raises US$60 million following competitors’ collapse. (Fortune)

Questions About Crypto? 🤔

Don’t worry, we’re here to help!

While we can’t provide specific investment advice, we do want to steer you in the right direction to stay informed. Please reach out to us and we’ll do our best to answer your questions.

This newsletter is geared towards traditional investors who are interested in the space. If you have suggestions on how we can improve our content or make it better, please let us know — we love feedback! Thanks for subscribing.