FTX Aftermath: Where To Go From Here

👉 Go here to sign up for our newsletter

It’s Friday! The weekend is here, and we definitely need it.

Ethereum and Bitcoin are holding steady after being derailed by the FTX news. Solana is taking the biggest hit and is down more than 17% over the past seven days and lost nearly 70% of its total value locked (TVL) since November 7. Both FTX and its sister company, Alameda Research, have heavily invested in Solana since December 2020.

The Latest Developments 👀

If you read our newsletter last week, we did our best to piece together the incalculable damage that Sam Bankman-Fried and his company caused investors. However, it almost immediately became dated after we hit send.

It’s been a mind boggling few weeks, topped off with a multi-million-dollar hack on the exchange and more disturbing details coming to light about FTX and its troubled founder.

SBF is no longer crypto’s “golden boy” that we once thought he was and has been likened to Elizabeth Holmes and Bernie Madoff by his former competitor.

Kelsey Piper, a reporter at Vox, shared DM’s she exchanged with SBF and the story pretty much wrote itself.

FTX getting financially obliterated wasn’t due to bad luck, crypto volatility or risk-taking; it’s from what appears to be “unsustainable layers of deception.” All the talk of effective altruism and working alongside American regulators to advance the industry? Purely a PR stunt.

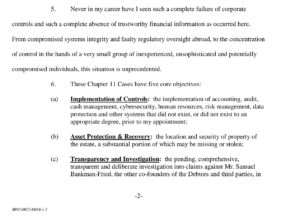

John Ray III, who led disgraced energy giant Enron through its bankruptcy proceedings, claims the situation at FTX was far worse, calling it a “complete failure” of corporate control in a recent filing. Ray was appointed interim CEO of FTX shortly after the exchange filed for bankruptcy protection on November 11.

The findings paint a disturbing picture of how FTX operated under SBF, including a lack of security controls and a central cash management system. Ray didn’t hold back in his evaluation on the state of the company:

So, What Does This Mean for the Industry? 🤷♀️

This entire debacle is a very cringey moment for crypto and you can bet investors will rethink their strategies when it comes to how they play the space.

Ether Capital CEO Brian Mosoff joined Bloomberg on Thursday and shared a few things to expect in the coming months. Here’s the TLDR:

- Institutions will be “pens down” or “take a pause on writing cheques” until they have more insight into how certain companies operate.

- Like Ether Capital, investors might seek exposure directly through the tokens themselves (i.e., ETH and BTC) if they are able to, rather than pick-and-shovel plays.

- More people will consider staking their ETH to generate yield. It’s a safer option to lock up ETH in a decentralized protocol rather than lend it to a centralized counterparty.

As we explained, this isn’t a failure of crypto, this is an example of bad actors who operate as central authorities with poor governance and a lack of oversight. Click here to watch the full interview.

There’s Work Ahead of Us 💪

Better access points are critical for widespread adoption, but they are also meaningless if users can’t trust them. This is likely why we have seen billions-of-dollars’ move off of centralized exchanges and DeFi protocols skyrocket in user activity over the past week.

In order to build back trust among retail investors, crypto companies need to take a page out of decentralized finance (DeFi) and provide greater levels of transparency when it comes to their assets and how they manage user funds.

We issued a press release earlier this week explaining why we value self-custody and hold ourselves to the highest standards when it comes to transparency and accountability. Protecting our assets is paramount, so in order to properly secure our ETH, we have build a custom solution using an auditor-approved, multi-signature wallet. This wallet is maintained by certain members of the management team and board of directors.

Other Canadian crypto businesses have also been making public statements in the wake of FTX’s downfall. Exchanges like WonderFi are completing proof-of-reserves audits and Tetra Trust outlined a strict set of rules and requirements it must adhere to in order to ensure customer funds remain protected. Additionally, Bitvo confirmed the acquisition agreement with FTX has been terminated and that it operates on a full reserves basis, never lending customer funds.

It will take time to regain user trust and centralized companies pulling back the curtain is a good first step. However, how much information businesses are willing to disclose, and how often, remains to be seen. We do still have a ways to go if we want to match the level of transparency that DeFi provides.

Ether Capital in the News 🗞️

The FTX story is taking up so much oxygen there’s hardly room for other news. We recommend checking out the recent interviews we did reacting to the latest developments:

- Wealth Professional: FTX collapse has undone years of progress, says crypto insider (November 15)

- Bloomberg: Bitcoin Miner Expects ‘Many More’ Bankruptcies After FTX Collapse (November 14)

- BNN Bloomberg: The FTX fallout is going to send a chilling effect through the industry: Brian Mosoff (November 11)

- CBC: He was hailed as crypto’s saviour. Now he needs billions for a bailout (November 10)

- The Canadian Press: Despite FTX crisis, it’s not the end for the crypto sector, says industry insider (November 11)

Confused About Crypto? 🤔

Don’t worry, we want to help!

While we can’t provide specific investment advice, we do want to steer you in the right direction to stay informed. Please reach out to us and we’ll do our best to answer your questions.

This newsletter is geared towards traditional investors who are interested in the space. If you have suggestions on how we can improve our content or make it better, please let us know — we love feedback! Thanks for subscribing.