ETH Rally + Spicy Takes on Regulation

👉 Go here to sign up for our newsletter

ETH Rally Continues 🤞

Rome wasn’t built in a day, and neither was Ethereum, the protocol that recently overhauled its consensus mechanism to Proof of Stake.

Ether saw its biggest weekly gain in three months rallying more than 16% last week. The positive change in tokenomics appears to be helping the world’s second largest cryptocurrency outperform BTC, which was up by just 5% over the same period.

There was a lot of excitement leading up to the Merge that occurred on September 15. We even published an op-ed about its significance. Sure, some people though it was overhyped, but if you ask us, we thought it was adequately hyped.

Here are a few important developments worth noting ever since the big upgrade:

- Ethereum’s energy usage has dropped by 99.95% reducing global electricity consumption by 0.2%.

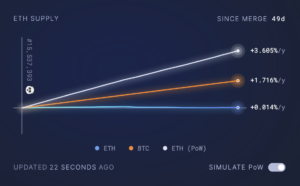

- Supply has increased by 1,300 ETH vs. the net-supply that would have been 480k+ ETH under Proof of Work.

- Ether is on track to becoming a deflationary asset. Net issuance has declined from 3.6% to nearly 0% since the Merge, dropping below bitcoin’s 1.7%, according to ultrasound.money.

- There is no longer sell pressure from miners that used to dump on average US$40M worth of ETH per day to offset the costs of their electricity bills, according to Cumberland.

- More than 2.6 million ETH (US$8.65 billion) has been taken out of circulation since August 2021 as a result of the Merge and EIP-1559 (London hard fork) that introduced a fee burn mechanism.

Our Take 💡

Ether becoming deflationary will likely attract investors who want to diversify their portfolios beyond bitcoin. The protocol already has first mover advantage and won over the vast majority of users and developers. It’s now only a matter of time before institutions fully recognize ether’s utility and competitive advantage over other bitcoin. In other words, Ethereum’s value proposition is becoming too big to ignore. Future upgrades that focus on scalability and staked ETH withdrawals is also likely to encourage more participation. Investors will start to separate the value of Ethereum’s underlying infrastructure from the latest meme token or NFT collection. In 10 years from now it’s anyone best guess as to what decentralized application stands the test of time, but if you ask us, there will always be future use cases for the blockchain itself.

ICYMI: Read our six takeaways from Devcon VI

Upcoming EthCap Events 📅

November 9th @ 9:00am ET: Jillian Friedman, COO of Ether Capital, will be speaking on a panel at the Canada Fintech Forum in Montreal about recent trends in the ecosystem post-Merge. Go here to register for the event.

November 10th @ 1:00pm ET: Brian Mosoff, CEO of Ether Capital, will be participating in a live webinar alongside Hal Lonas, CTO of Trulioo, about what it will it take to drive the next wave of crypto adoption. We’ll focus on the KYC/DeFi dilemma, regulation, consumer protection and improving the end user experience. CoinDesk is hosting and it’ll be a good one, so make sure you sign up!

What Caught Our Attention 👀

The Crypto Story of Crypto Stories 📖

It’s hard to find commentary about crypto that isn’t riddled with skepticism or a straw man take on the industry. There’s usually no in-between and it can be annoyingly difficult to find neutral ground.

Bloomberg financial columnist Matt Levine did an excellent job explaining the idea behind cryptocurrency and blockchain in his recent feature “The Crypto Story.” Levine focuses on what all means and why it matters, breaking it down in layman’s terms and drawing parallels to everyday life. He also gets bonus points for not being someone who is heavily invested in crypto or vehemently against it; just a guy who likes finance.

Levine’s 40,000 word article also filled the entire edition of Businessweek front to back — something that has only been done once before in the history of the magazine. It’s a great read no matter how you feel about the sector. Go here to access the full online version.

SBF vs. Erik Voorhees 💥

If you missed the spicy Twitter debate featuring FTX founder Sam Bankman-Fried and ShapeShift founder Erik Voorhees, you’re in for a treat.

The TLDR is SBF published a blog post proposing a set of industry standards that could be imposed or adopted. Voorhees, a libertarian and early crypto adopter, responded and deconstructed SBF’s proposal. SBF attempted to calm the waters with an extensive Twitter thread after receiving backlash from the community. It’s a delicate dance and the same argument that is at the heart of every debate on crypto regulation: How do you impose strict measures on an open, permissionless global network? Bankless hosted a live stream last Friday with the two founders that’s definitely worth watching.

ICYMI: We hosted a webinar with SBF in May where we got his take on what regulation including the challenges when it comes to KYC in DeFi. Go here to check it out.

Newsworthy Links & Highlights 🗞️

- JPMorgan traded tokenized cash deposits on-chain as part of a pilot project — a move that is being touted as a “monumental step forward” for DeFi.

- A new global survey by Cointelegraph Research shows institutional investors are more likely to buy ether (62%) than bitcoin in the next 12 months (54%).

- Here’s what to expect from the next big Ethereum upgrade that will enable Staked ETH withdrawals.

Confused About Crypto? 🤔

Don’t worry, we want to help!

While we can’t provide specific investment advice, we do want to steer you in the right direction to stay informed. Please reach out to us and we’ll do our best to answer your questions.

This newsletter is geared towards traditional investors who are interested in the space. If you have suggestions on how we can improve our content or make it better, please let us know! Thanks for subscribing.