2023: The Year of Staking

gm,

The staking landscape is heating up with Shanghai just around the corner (currently scheduled for April 12). It’s the upgrade that will finally enable staked ETH withdrawals, and if everything goes according to plan, we can expect investor appetite — especially from institutions — to increase.

Shanghai Upgrade & Staked ETH Withdrawals 💸

Unlike in crypto, traditional companies aren’t necessarily able to “move fast and break things.” Although they might be interested in increasing exposure to certain assets or crypto-native activities, it doesn’t always mean they have the green light. There’s a dichotomy as to what plays out in the cryptosphere vs. what happens in the traditional finance world. Most businesses must adhere to a strict set of rules, standards and accounting practices. Imagine telling your Chief Risk Officer that the $14 billion in ETH you want to stake can only be withdrawn “when the protocol is ready.” The good news is, this will no longer be a roadblock and Shanghai will remove much of the uncertainty when it comes to ETH liquidity.

Opportunities for Institutions Post-Shanghai 🏦

Earlier this week, we dove into the subject of institutional ETH staking with ether.fi and Attestant. Ether Capital CEO Brian Mosoff outlined three predictions in a post-FTX world that will likely benefit large investors and the industry as a whole:

- Institutions at one point thought the safest play was investing in the companies themselves vs. bearer assets. This was, of course, before the collapse of big players in the space like FTX, Celsius, Voyager, Three Arrows Capital, etc. Now investors are starting to rethinking their approach and increase token exposure.

- The Ethereum killer/alternative Layer-1 narrative is finally dying off with the advancement in ZK and Layer-2 technology that bolsters the Ethereum ecosystem. For institutions, it makes their investment decisions much easier and they can justify putting their money behind an asset like ether that underpins all activity taking place on the protocol.

- More access points and ways for institutions to participate will emerge once ETH withdrawals are enabled. ETH liquidity creates new opportunities and investors have options as to whether they want a provider to stake ETH on their behalf, or if they would prefer a structured product that gives them staking exposure and yield.

We also talked about centralized vs. decentralized staking solutions, custody and other key themes to watch out for this year. You can go here to listen to the full episode.

TradFi Meets Liquid Staking 💰

Rocket Pool also invited us to join their Spaces last week. We discussed details about our new staking dashboard and talked about how institutions are approaching liquid staking. Here’s a good TLDR recap on Twitter that summarizes our conversation.

Rocket Pool is the largest decentralized liquid staking protocol and one of the most reputable names in the space. It was fun to catch up with them and share our journey as a public crypto company.

So far, Ether Capital has staked ~80% of its portfolio (36,000+ ETH) and we’re thinking about our strategy post-Shanghai. Concentration among clients and staking providers in the ecosystem is a persistent challenge and something that companies like ours can help resolve.

As Brian explains during the Spaces with Rocket Pool, what we hope to eventually see is large investors use multiple custodians and staking solutions that help further decentralize Ethereum. It not only protects the protocol, but investor capital as well.

Dashboard Updates 💻

Our staking dashboard has been open to beta testing for just over a month now and the sign-ups continue to roll in.

We created this tool because we want more transparency into our staking operations. Aside from closely monitoring validator performance, we needed a better way to track our financial data and staking revenue instead of running excel spreadsheets. We had basic network-level stats but needed more granular data.

To us this dashboard is mission control. It provides the ability to track your rewards, monitor validator uptime, and see how you perform on any given day. There are a lot of great features in the pipeline, including the ability to oversee multiple staking operations at once, track MEV, benchmark validator performance, and receive notifications (stay tuned for more details on that).

We’re excited that it’s now out in the wild and in live beta mode. Register today to join our free beta program and help us take our product to the next level!

You can also access our public Discord server where we’ll share dashboard updates and answer any technical questions you have in (almost) realtime.

EthCap In The Spotlight ✨

Constantin Lobov, product manager for Ether Capital, gives a presentation at a recent DeFi Toronto meetup

It’s been a busy year so far and there have been no shortage of industry events. Here are some of the recent talks and panels we participated in:

- Don’t Trust, Verify What’s at Stake: Members of our team conducted a live presentation and demo of our staking dashboard at ETHDenver.

- Ether Capital COO Jillian Friedman hosted a panel on the future of distributed validator technology (DVT).

- Ether Capital CEO Brian Mosoff participated in the Staking Rewards online forum that explored different ETH staking opportunities for institutions post-Shanghai.

Newsworthy Links & Highlights 🗞️

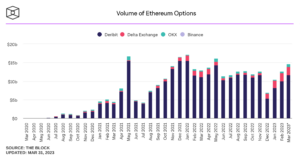

- Monthly options volume for ether reached the highest level since May 2022 as the Shanghai upgrade nears. (The Block)

- EigenLayer, a restaking protocol that aims to extend crypto-economic security to applications being built on Ethereum, announced a $50 million Series A fundraise. (Blockworks)

- Citi says trillions of dollars worth of assets could be tokenized by 2030 (March 2023 report).

- The CFTC sues Binance and company CEO Changpeng (CZ) Zhao for allegedly violating U.S. laws. (court documents)

Questions About Crypto? 🤔

Don’t worry, we want to help!

While we can’t provide specific investment advice, we do want to steer you in the right direction to stay informed. Please reach out to us and we’ll do our best to answer your questions.

This newsletter is geared towards traditional investors who are interested in the space. If you have suggestions on how we can improve our content or make it better, please let us know — we love feedback! Thanks for subscribing.