We Staked More ETH

Sign-up to our newsletter

gm frens, Happy New Year! 😎

We announced some pretty big news earlier this week…

Our Staking Game is Strong 💪

We staked an additional 7,488 ETH (roughly C$14.2 million equivalent)! This means we have locked up a total of ~28,000 ETH — more than 62% of our portfolio — and are currently generating yield at approx. 4%.

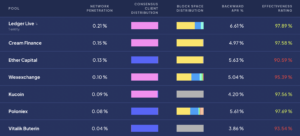

Ether Capital is now one of the largest entities to stake the most ETH, according to rated.network. This is something we are very proud of! 🏆

Staking has always been a fundamental part of our roadmap since our inception in 2018. In fact, it wasn’t too long ago that we became the first public company in the world to stake a large quantity of ETH pre-Merge and intend to use a portion of our staking revenue to continue building out our business.

Bullish on ETH Staking 📈

We joined CoinDesk TV to discuss our staking strategy and why we are all in on Ethereum despite many other companies pulling back from the space.

Ether Capital’s 2023 Outlook 🔮

Investors remain uncertain (or bearish) on how things will play out in 2023. We’re seeing large companies lay off staff and institutions reassessing how they will deploy capital after witnessing last year’s meltdowns. We don’t always have the ability to peer around corners in crypto, but we do know that crypto winters don’t last forever. Here are a few themes we expect will play out in the months ahead:

1. Less speculation, more building 🛠️

Bear markets have great noise cancelation effects. The hype that usually drives the price of certain assets through the roof will die off and investors can (finally) start to pay attention to innovation that will be here in five, 10, or 15 years. This is also a time when those who are dedicated to the space will work on building better products or services. We like to say “follow the developers,” and it’s true. This is a period when great ideas are born and hackathon projects turn into multi-billion-dollar protocols. So, we’ll see you at ETHDenver in March?

2. Ethereum upgrades on the horizon 🌅

The Merge was a watershed moment for the industry in 2022; a major infrastructure upgrade that was years in the making. Right now, all of the excitement is about the Shanghai hard fork (scheduled for March 2023) that will enable staked ETH withdrawals. There’s also a good chance investors who were warming up to staking will now be confident enough to allocate their ETH to securing the network and generate yield in the process. On top of that, an Ethereum upgrade that addresses scalability (i.e., proto-danksharding) is expected to take place later this year. When it comes to the competition, Ethereum is no longer an appropriate match for alternative Layer-1 blockchains. Rivals that are vying for user and developer activity will have to take on Layer-2s that already have a combined US$4.62 billion in total value locked (TVL). Godspeed. 🖖

3. Tokenization of real world assets 💰

We expect 2023 is the year we’ll see tokenization of real world assets on Ethereum. A group of 12 banks including Bank of America and Citi are already exploring this process and once Ethereum becomes more scalable, other institutions will likely jump on board. JPMorgan recently participated in a pilot project using Polygon (an Ethereum L2) and Aave (a multi-chain DeFi network) to trade tokenized bonds and foreign currencies — a big sign of faith for the future of cryptocurrency and blockchain.

4. ZK and L2s Steal the Spotlight 🔦

If Ethereum is to go from processing 13 transactions per second to 13,000, it needs to be able to scale. This is where zero-knowledge (ZK) proofs come in. In addition to L2s, ZK proofs compress data off-chain to improve throughput and reduce bottlenecks on Ethereum’s mainnet. ZK was a hot topic at last year’s Devcon and we expect the technology will continue to play a vital role in the ecosystem going forward. Ethereum’s co-founder Vitalik Buterin also said he believes that ZK SNARKs (a type of ZK proof) will be as important as blockchain within the next decade.

5. Regulation or education? 👩⚖️

Although regulation feels like an arduous process, we understand it takes time for lawmakers to get up to speed before implementing hard and fast rules that the industry must abide by. Canadian regulators have issued guidance related to stablecoins and cryptocurrency exchanges/trading platforms in the past, but we expect most of 2023 will be about education and regulators developing a better sense of how innovation, such as DeFi, works.

Newsworthy Links & Highlights 🗞️

- Crypto traders are placing bets on Ethereum’s Shanghai upgrade

- Staked ETH passes 16M (US$22 billion) in deposits

- Genesis and Gemini are slapped with charges by the SEC for allegedly selling unregistered securities

- Crypto.com, Coinbase, Huobi and Genesis are some of the latest companies to announce layoffs amid FTX fallout.

- AWS partners with Ava Labs to scale blockchain solutions for enterprises, governments.

Confused About Crypto? 🤔

Don’t worry, we want to help!

While we can’t provide specific investment advice (like the cat above), we do want to steer you in the right direction to stay informed. Please reach out to us and we’ll do our best to answer your questions.

This newsletter is geared towards traditional investors who are interested in the space. If you have suggestions on how we can improve our content or make it better, please let us know — we love feedback! Thanks for subscribing.