Projections Based On Past Experiences

Sign-up to our newsletter!

Impressive Gains for ETH & BTC 📈

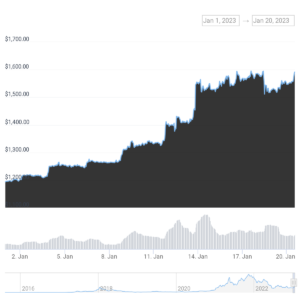

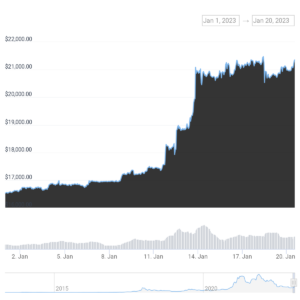

It has been a strong start to the year for the top two cryptocurrencies by market cap. Both ETH and BTC are up 25% over the past two weeks, which has many investors scratching their heads after an abysmal performance in 2022.

YTD price chart of ETH above in USD (Source: CoinGecko)

YTD price chart of BTC above in USD (Source: CoinGecko)

The tokenomics and value propositions remain the same, so what’s the deal?

Some market analysts predict BTC could be up on anticipation that U.S. interest rates will be lowered and investors perceive it as a less risky asset. Others suggest crypto whales might be responsible for the latest price rally. According to crypto data firm Kaiko, trade sizes have climbed from an average of US$700 per day to US$1,100 per day on Binance since January 8th.

Positive price action for ETH feels a little more straight forward though. Ethereum clocked another milestone last week and there are now more than 500,000 validators approving transactions on the network. Ethereum developers have also indicated substantial progress toward the Shanghai upgrade aimed to enable staked ETH withdrawals. With the implementation of distributed validator technology (DVT), we can expect the staking landscape on Ethereum to become more decentralized and immune to single points of failure as the industry progresses.

💡 DVT is an infrastructure primitive that allows an Ethereum PoS validator to run on more than one node or machine. Therefore a cluster of nodes operated by an individual(s) or company can act in concert as a single validator on Ethereum. This ultimately makes staking more accessible for all validators while contributing to decentralization and improving network resiliency.

Our take

Overall, we see staking as a great way for investors to capture yield by turning ETH into a productive asset. There’s no counter party risk because the counter party is the protocol itself. Where users run into trouble (as we’ve witnessed many times in the past) is when they deposit funds into centralized entities that are opaque and under-collateralized. With staking, validators lock up tokens to secure the underlying network and receive staking rewards in return. The best part? Everything is document on-chain. Staking upholds the initial promise of crypto, which is to circumvent unnecessary rent-seeking intermediaries allowing users to have sovereignty and true ownership over their assets.

We Staked More ETH 🥩

ICYMI we staked an additional 7,488 ETH last week bringing our total staked ETH balance to 28,000 ETH (62% of our portfolio)! Hats off to the team at Figment who are running our validators.

We also caught up with CoinDesk TV about why we chose to stake more of our ETH balance and shared our industry outlook for 2023.

New Report: Beyond Blockchain 🔭

Hindsight is always 20-20, especially when it comes to crypto. But it can be helpful to predict what’s ahead based on past experiences.

We were honoured when asked to write a foreword for the latest CryptoEQ research report that delves into the current state of digital assets and institutional adoption. As someone who has lived through many cycles, Ether Capital CEO Brian Mosoff shares his views on how the industry started and what’s in store for 2023 and beyond.

BTW the talented team at CryptoEQ puts out stellar research on various industry topics. If you want to fall deep down the rabbit hole but not get lost in jargon, we recommend you check them out. #knowledgeispower

Come Work With Us! 👩💻

Ether Capital is hiring a front-end developer to join our team (4-month, full-time contract position with the possibility of extension). This is a good opportunity if you are passionate about the future of crypto and looking for a new challenge!

Please send your resume and work examples to [email protected]. You can also find out more about the position on the careers page of our website.

Newsworthy Links & Highlights 🗞️

- Genesis files for Chapter 11 bankruptcy protection.

- Flashbots, an organization that strives to mitigate the negative effects of MEV by making it a more fair and transparent process, is reportedly in discussions with potential backers about raising up to US$50 million at a US$1 billion valuation. We talked about MEV in our Devcon VI blog post.

- MetaMask is now letting users globally stake ETH with liquid staking providers, Lido and Rocket Pool.

- Coinbase announces it is halting operations in Japan.

Confused About Crypto? 🤔

Don’t worry, we want to help!

While we can’t provide specific investment advice, we do want to steer you in the right direction to stay informed. Please reach out to us and we’ll do our best to answer your questions.

This newsletter is geared towards traditional investors who are interested in the space. If you have suggestions on how we can improve our content or make it better, please let us know — we love feedback! Thanks for subscribing.